Inland Revenue Survey Maps and Field Books

Inland Revenue Survey Maps and Field Books

The Purpose of this Guide

This guide will explore and explain the records of the Inland Revenue (Scotland) (IRS) survey of land values and ownership, which took place during the years 1910-1915. This massive survey, implemented by the newly-formed Valuation Office, recorded information on 99.7% of all land in Scotland. These records have been reasonably underused by researchers until now, but have the potential to offer excellent insight into the Scottish rural and urban landscapes at that time.

The two main series of archival records that relate to the survey are a set of specially-annotated Ordnance Survey maps of all valued land portions, termed 'hereditaments'. These provide a graphic-index to an accompanying collection of field books in which surveyors recorded values, particulars, and comments on land portions and properties. All of these records are arranged within the large IRS series. The maps and field books have all been digitised, allowing for swifter, easier access for readers to the Historical Search Room. This guide will also define how to successfully search these records for the purposes of historical enquiry.

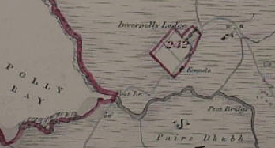

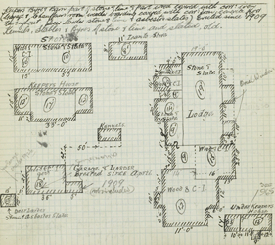

Images below illustrate how the IRS Maps and Field Books compliment one another. On the left is a magnified image of Iverpolly Lodge and Gamekeeper's House, Ross and Cromarty, as defined on a specially annotated 6 inch OS map (National Records of Scotland, IRS126/3). On the right is a sketched plan of this property, extracted from a corresponding surveyor field book (National Records of Scotland, IRS80/93 entry 242).

This demonstrates the level of detail that IRS staff often went in to, in order to ascertain accurate valuations.

Historical Context to the Survey

In the late nineteenth and early twentieth centuries land ownership in Scotland, and Britain as a whole, was an extremely emotive subject. Historic local quarrels against landowner absenteeism and disinterest were being increasingly mixed with agitation on the perceived injustice that landed elites were benefitting from enhanced land values; brought about not by their own investment, but by greater state investment in roads and communications.

In response, and despite great political opposition, David Lloyd George, the Chancellor of the Exchequer, managed to push a bill through Parliament that sought to accrue more financial contribution from landowners in this regard. An aspect of the Chancellor's famous 'People's Budget', the Finance Act of 1910 empowered the Inland Revenue, in the guise of the Valuation Office, to conduct a physical survey and valuation of every piece of property in Britain and Ireland. This would create a 'datum line' of values (as at 30 April 1909) from which the levying of a new increment value duty on all future sales and transfer of land or property could be based.

In Scotland, every portion of property, and their applicable boundaries, were marked onto specified Ordnance Survey maps and given individual assessment numbers, unique to the parish, burgh or ward in which they sat. Four-page entries on each of these portions were then recorded in an accompanying field book in which the situation, size, ownership, insurance, physical particulars, and values were noted.

However, partly due to the consistent hostility of the landed classes and the consequences of the Great War, the increment value duties never really came to bear; and the scheme was abandoned in 1920. Nevertheless, the records of the survey created a benchmark for future land purchase and ratings reform, and are a fantastic archive of geographical, archaeological, and social information for pre-War Scotland.

The Survey Process

The Valuation Office established ten, later twelve, individual valuation districts in Scotland which were comprised of a number of income tax divisions, these being considered the most convenient units for administrative purposes. Initial information on ownership, tenants, insurance, ratings (where known) past sales etc. was collated using existing sources and in the return of questionnaire forms from landowners, in particular the 'Form-4 Land'. These return forms were never formally preserved, but may be found within various private archival collections. It was certainly in the owners' interests to record information accurately, as a dubiously low initial value could lead to a much higher increment duty being applied in the future. Once this initial stage was completed, the valuation staff then went into each district to inspect every hereditament, delineate its boundaries on a map, and record its particular values in a field book. Some properties were exempt from increment value duty, but each and every hereditament was recorded where possible, whether exempt or not. The NRS has some records relating to questions and disagreements between a number of landowners and the Inland Revenue (e.g. see GD325/1/163 for comment on the "spirit of hostility" being shown to landowners), but general files relating to the work of the survey are held at The National Archives in London.

For rural areas, hereditaments were grouped together by civil parish or burgh, arranged within applicable pre-1975 county series. For example, a field book entry for a croft in the vicinity of the village of Tayvillach, would be found within the books relating to North Knapdale parish, county of Argyll (National Records of Scotland, IRS54/209-210). Urban areas were arranged by county, and then either by burgh, parish or, most likely, by ward. So, for example, entries for businesses that line George Street in Edinburgh would be found within the field books relating to Ward 11, within the county series for Edinburgh and Leith (IRS65/279-301). It is much easier however to determine which field book to consult by firstly inspecting an IRS map.

Typical Enquiries

The most obvious use for the IRS records is for determining the ownership of land and buildings for legal purposes or for historical research. As this was the only cadastral (map-based) survey of property ownership attempted before the advent of electronic title in Scotland, the IRS plans and field books comprise a valuable starting point for determining who owns or owned a piece of land or a building.

Once the owner of a property in about 1910-15 can be determined from the IRS records, other records, such as the register of sasines and valuation rolls can be used to trace previous owners or to follow changes in ownership forward to the present day.

There are three main types of historical enquiry that these records may be potentially useful for. Undoubtedly, their major advantage is their coverage of all land across Scotland, and their emphasis on defined property boundaries.

-

Local History

The potential for unearthing historical facts, as well as anecdotes, into local areas and social communities across Scotland is great. Strict statistics on the value of major landowning estates could be compared for example; as well as assessing varying agricultural practice and landowner absenteeism. The changing relationship between urban and rural environments; the altering face of industry; and the emerging rise of a new class of small estate owners can be contrasted: National Records of Scotland, IRS68/50 entry 107 for instance records a sale of Barrisdale Bothy in 1893. Anecdotal information can also be gleaned: the entry for Lewis Castle shows that the owner provided accommodation for some ten servants; the capacity of local schools and churches is often mentioned; and there is interesting detail on the 18 stags who roamed the moors surrounding Inverpolly Lodge (National Records of Scotland, IRS80/93 entry 243). -

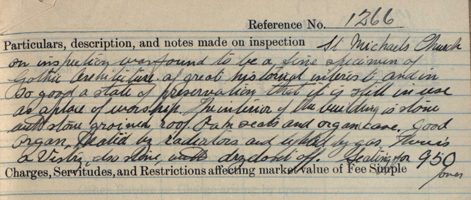

Archaeology and Architectural History

Surveyors often commented on the "historic value" of certain sites, and how this affected their overall value. Linlithgow Palace for example (National Records of Scotland, IRS86/94 entry 877) was estimated, rather nonchalantly, to have an historical value of, "say £10,000", and Torphichen Preceptory's western door is faced by "fine ground arching" (IRS86/125 entry 590). Information on buildings now demolished can also be recovered through these records. St Andrew's Halls Theatre in Glasgow, which was heavily damaged by fire in 1962, is recorded along with a sketch plan within entry 377 in IRS67/150.

The Population of Handa Island (left), felt the effects of the potato famine, and this island was abandoned by 1848. In 1915, it represented a single hereditament to its owner, the Duke of Sutherland, with the Field Book entry noting only a "stone, lime and corrugated iron roofed building" on its landscape (National Records of Scotland, IRS131/61). Rosemount House, sketched here on the right, sat on a site in Riddrie, Lanarkshire, now occupied by St Thomas the Apostle Roman Catholic Church and Primary School (National Records of Scotland, IRS67/315 entry 412).

-

Family History

There is also potential to enrich circumstantial evidence on an ancestor's home or work address, which may have been previously accrued through sources such as the 1911 census. As late as 1872, over 96% of property and land in Scotland was rented, and the IRS records could be used to delineate an ancestor's lease; describe their lease arrangements and responsibilities, and provide insight on their living conditions. This information could also be cross-referenced with other records such as Valuation Rolls, Sasines, and wills to create more of an understanding of a forbear's world, and provide anecdotal detail on daily life: the yearly rent paid by the tenants of the Inverie Temperance Hotel, Knoydart, included the right to graze two cows on "the Common" (IRS68/50 entry 117). These records may also fill a gap with the memories of living parents and grandparents.

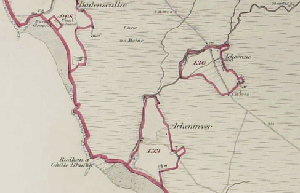

Section of Lochbroom Parish, Ross and Cromarty, as mapped by IRS Surveyors, showing delineations of separate crofts (National Records of Scotland, IRS126/16).

How the Records Work

- Maps (National Records of Scotland, IRS101-133)

The surveyors used six different scales of maps to label the boundaries of hereditaments, depending on the context of the environment in which they were working. It was decided that the largest available OS scale for each area would be used, to make boundaries as clear as possible. Those maps used were mostly OS second editions, but first edition large scale maps were also used. If maps wore out, information was transferred to post-1920 maps, but the unique hereditament assessments should have stayed the same. The scales for maps, and what terrain they were usually used for, are as follows:

- 1/10560 (6 inches to the mile) = The smallest scale map was used for very rural areas, such as moorland and upland

- 1/2500 (25 inch) = This was the standard scale used, used for covering rural and partially urban areas. Field acreages and building names were incorporated into this.

- 1/1250 (50 inch) = Used for urban areas, these were simply a magnified version of a 25 inch portion

- 1/1056 (60 inch) = For urban areas, possibly 1st edition

- 1/500 (127 inch) = For densely populated areas and city centres, these maps were specially created and contain specific information on names of detached houses, width of street pavements, layout of gardens etc.

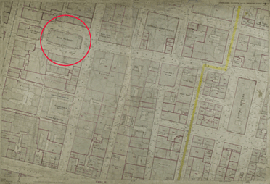

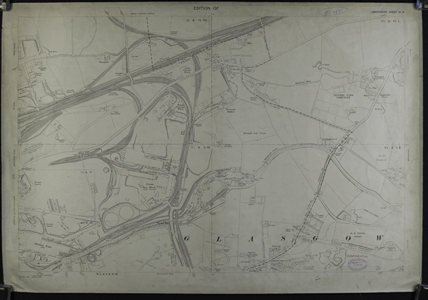

Royal Exchange Buildings, central Glasgow, which now houses the Glasgow Museum of Modern Art. This building, situated in a densely built-up area, is delineated on a 1/500 scale map, and has been given assessment number '352', applicable to a particular city ward, in this case Glasgow City Ward X. The image on the right shows this hereditament's position on the wider map. The yellow line on the map marks Ward X's boundary with Ward IX. (National Records of Scotland, IRS118/837).

Identifying which map to inspect in order to obtain an applicable hereditament number can be frustrating, and does require patience and pragmatism. Local knowledge of the area in question is also useful. The first thing to do is establish which 1/10560 (6 inch) standard OS sheet number covers the area in question. There are two ways to do this.

Identifying a Map in the Historical Search Room

The large County/Parish Key sheets can be consulted from which the 6 inch sheet number can be obtained. There is good explanation at the front of this volume on how old OS sheet numbers work, but below is a rough guide to this:

-

When surveying areas in greater detail, all OS grid references derive from the overarching 6" sheet (1/10560) for that area. When calculating the position of a 25" grid, the 6" maps are theoretically subdivided into sixteen separate 25" (1/2500) grids, which are numerically ordered as follows:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 -

If a greater scale map was required for a more densely populated area, a covering 25" grid was theoretically subdivided into four 50" (1/1250) squares, and arranged as follows:

NW NE SW SE -

25" grids could also be broken down into twenty five grids of 1/500 (127") grids whenever a very urban area, with lots of detail, was mapped:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

For example, the map showing the Royal Exchange building above is catalogued as OS sheet number VI.11.11 (National Records of Scotland, IRS118/837). This reference translates as 127" grid number 11, which is part of 25" grid number 11 within the wider 6" sheet number IV for Lanarkshire, Glasgow & Environs.

There is more guidance on this technical issue within chapter 5 of Geraldine Beech and Rose Mitchell's Maps for Family and Local History (Kew, 2004). It is important to remember as very often readers are likely to come across IRS maps which contain no boundary details. This means that a bigger scale was deemed necessary by the surveyors, who would label a corresponding, larger scale map with the vital boundary data.

25 inch (1/2500) map of Riddrie, Lanarkshire. This shows how this mapped area has been split into four sepearate 50 inch (1/1250) plan squares by the surveyors, onto which they drew boundaries and numbers for applicable hereditaments (National Records of Scotland, IRS118/77).

Once the correct map is identified, users can consult the manuscript IRS catalogue lists from which a map reference number can be ascertained and input into Virtual Volumes. The maps are arranged alphabetically by county, and then within county by parish, burgh of ward.

Identifying a Map from Home

It is possible to identify which 25" 2nd edition map is applicable to a particular area by using the Scotland's Places website. See below for a search for the village of Aberfeldy:

- Please select the relevant county.

- Select the parish you are interested in by either clicking on the parish location on the map or the ‘refine by parish’ link under the map.

- Select the “2nd and later edition 25-inch” link next to the map.

- Select the plan covering the area of interest. A quick preview of the 'Perth and Clackmannan Sheet 49.06' shows this is the right one for our intents and purposes. Remember that the first part of this sheet number, needs to be translated to Roman numerals (XLIX), to correspond to the original 6" OS grid number.

With this sheet number in mind, a search of the NRS online catalogue will translate this OS grid number into an IRS number. Enter the sheet number and the relevant county name ('XLIX.6' ‘Perthshire’) in the "Search for" field and hit the search button. Three IRS maps (IRS124/145-147) contain information on this particular area.

These IRS maps can then be viewed in the Historical Search Room on Virtual Volumes.

This technique is very useful for assessing urban properties, as the map of Scotland on Scotland's Places can be 'zoomed' into, and 25" grid determined quickly and easily, for further investigation in the Search Room.

- Field Books (IRS51-87)

Once an hereditament number has been identified on a map, its recorded valuation entry can be consulted in a corresponding field book on Virtual Volumes. These are arranged by county, and then within county by parish, burgh or ward. Each field book contains entries for 100 hereditaments applicable to a certain vicinity, so for example IRS87/48 contains information on hereditament numbers for Portpatrick Parish, Wigtownshire, entries 101-200.

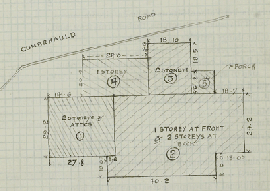

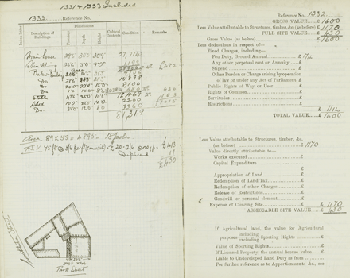

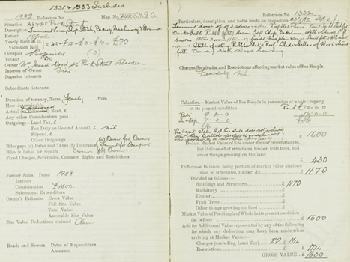

These books were pre-printed, and four separate pages were set aside for each hereditament. The details from the returns form, including the details of owners, tenants, and rent, were recorded on the first page. The second and third page were for comments on the particulars of the property such as its building materials, facilities, state of repair, water supply, drainage, land use etc. This was normally quite fully recorded so as to avoid future dispute. These pages were also frequently given over to calculations on the size and value of the hereditament, and occasionally the surveyors found time to create individual sketch-plans of properties, to aid understanding and analysis. These plans were largely excluded from entries post-1912 owning to greater time constraints. The example below for an Aberdeen bakery business gives insight on how well recorded these can be:

Full four-page field book entry for 46 and 48 Park Street, St. Clement's Ward, Aberdeen, owned by a Mrs Jessie Wood (National Records of Scotland, IRS51/14 entry 1332).

The last page of each entry contains the values for the property. They are categorised as follows:

- Gross value = market value of the site, free of encumbrances

- Full Site Value = Gross value of site minus the value of any buildings within it

- Total Value = Gross value minus fixed charges, rights of way and rights of common

- Assessed Site Value = Total Value with the same deduction made to arrive at Full Site Value from Gross Value, but with additional deductions for owner investment on site improvement; it was from this 'datum' value that future increment value duty was assessed.

Tips and Tricks

Despite their consistent structure, the overall content of field book entries can vary dramatically. The following are points to bear in mind when researching these records.

-

Sections of particular entries in the field books will be blank. There may be reference to another record, such as a note to, "see file", "particulars in Form 4", or "for sketch see case". This relates to accompanying documents the surveyors used in the field, but unfortunately none of these survive. These omissions frequently affect large estates and civic buildings, but not exclusively. In some cases data fields will be left blank altogether, with no relating reference.

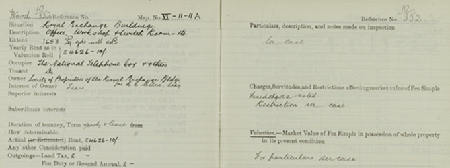

Section of field book entry for Royal Exchange Buildings, showing 'see case' references (National Records of Scotland, IRS67/123 Ward 10 entry 352).

-

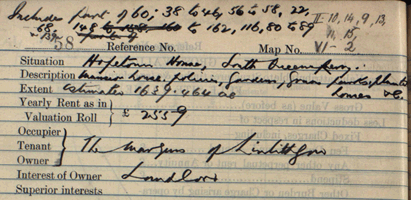

When a number of hereditaments were owned by the same person, often all applicable valuation data would be recorded within one entry. So, for example, entry 58 within field book IRS86/1 is the main entry for Hopetoun House, owned by the Marquis of Linlithgow, yet this incorporates valuation data for some 42 other hereditaments which were part of this estate. Frustratingly, but unsurprisingly, owing to its sheer size, comment on the physical particulars of this estate was recorded within an accompanying "file", now lost. Similarly, an entry which relates to an outlying part of an estate may refer you to another entry, perhaps in another field book, that contains the combined estate's valuation data.

-

On occasion, even valuation data can be omitted within field book entries. The entry for Barlinnie Prison within IRS67/315 contains nothing other than the acreage of the site. This may mean that the site was exempt from increment value duty.

-

Helpfully, references to bordering parishes, and bordering OS sheet numbers, were included in the margins of each map. This makes it fairly simply to ascertain which map to consult in order to view neighbouring hereditaments. This is particularly important if assessing hereditaments on the edge of particular parishes or counties, as it is likely that corresponding maps will need to be checked.

-

It is likely that some degree of information will be available for practically all land in Scotland. However, as has been suggested, each case is dependent on where it was situated; who owned it; and by whom it was surveyed and when.

Entry for Hopetoun House, shows its combined valuation for 42 other listed hereditaments (National Records of Scotland, IRS86/1).

Further Reading

- Geraldine Beech and Rose Mitchell, 'Maps for Family and Local History' (London, 2004).

- Brian Short, 'The Geography of England and Wales in 1910: An Evaluation of Lloyd George's "Domesday" of Landownership' (Historical Geography Research Series No.22, 1989).

- Brian Short, 'Land and Society in Edwardian Britain' (Cambridge, 1997).

- Andy Wightman, 'The Poor Had No Lawyers- Who Owns Scotland and How They Got It' (Edinburgh, 2010).

- The National Archives online guide, 'Valuation Office Survey: land value and ownership 1910-1915'.